Sin City Insights: Understanding the Las Vegas Housing Market

- Cole Lake

- Jun 15, 2025

- 14 min read

Las Vegas Real Estate Market Snapshot: Understanding Today's Trends

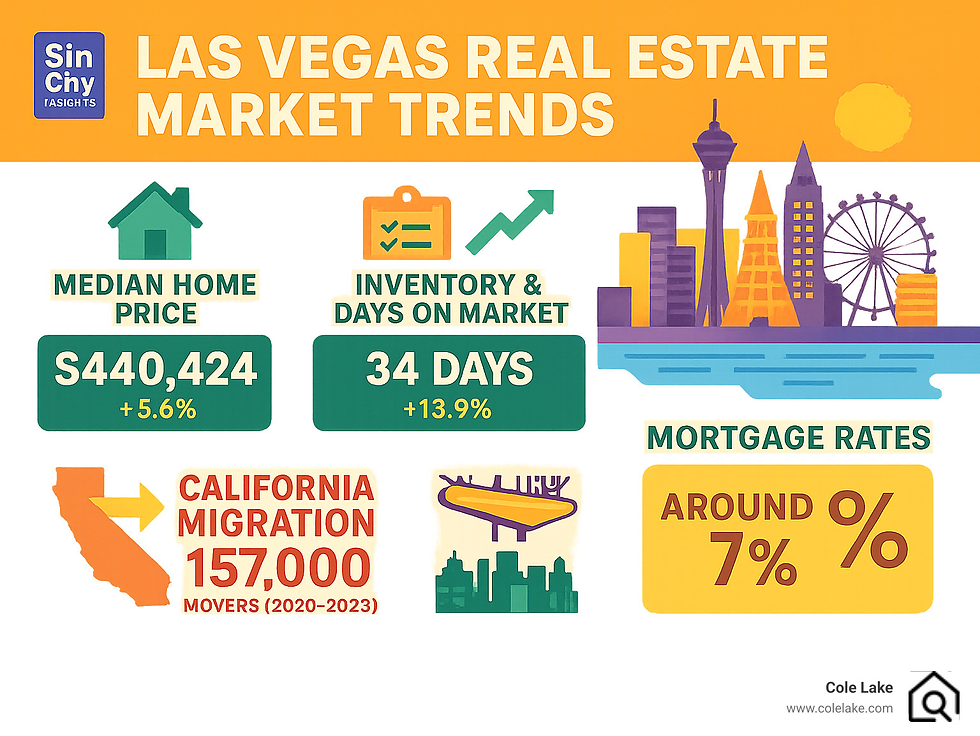

The Las Vegas real estate market analysis shows a market in transition with key indicators pointing to a more balanced environment in 2025:

Median home price: $440,424 (up 5.6% year-over-year)

Average days on market: 34 days (down from 41 days last year)

Current inventory: 9,908 homes (up 13.9% from previous month)

Market status: Neutral market (shifting from seller's market)

Mortgage rates: Around 7% as of January 2025

Nationwide, 2024 saw one of the slowest years for real estate in three decades, but Las Vegas has bucked this trend. The allure of nightlife, favorable climate, and tax benefits continue to drive demand despite affordability challenges. With inventory growing and home prices plateauing at healthy levels, buyers are finding more options while sellers still maintain pricing power in desirable neighborhoods.

The Las Vegas housing market has solidified its reputation as one of the most dynamic real estate markets in the United States. Migration patterns, particularly from California, have been a significant driver of demand, with over 157,000 Californians relocating to Nevada between 2020 and 2023. This influx, combined with limited housing supply, has created a competitive environment that continues to evolve.

I'm Cole Lake, a Las Vegas Realtor with extensive experience conducting Las Vegas real estate market analysis for clients ranging from first-time homebuyers to seasoned investors. My approach combines data-driven insights with neighborhood-specific knowledge to help you steer this complex market.

Las Vegas Real Estate Market Analysis: 2025 Mid-Year Check-In

As we reach the halfway point of 2025, the Las Vegas housing market continues to show its trademark resilience. If you've been watching the market, you've noticed some interesting shifts happening right before our eyes.

Current inventory has climbed to approximately 9,900 homes for sale – a healthy 13.9% jump from just last month. While this gives buyers more breathing room than the frantic days of 2021-2022, we're still not back to pre-pandemic inventory levels.

The median sale price in Las Vegas now sits at $440,000, up 7.3% from this time last year. That steady appreciation is happening despite higher mortgage rates. Looking at price per square foot, properties are selling at about $259 – a 9.7% increase since last year, which outpaces the overall median price growth.

Homes here are selling after an average of 34 days on market, down from 41 days last year. The average sale-to-list price ratio holds strong at 98.9%, meaning sellers are typically getting very close to their asking prices.

When we compare Las Vegas to national averages, our desert oasis stands out:

Metric | Las Vegas | U.S. Average | Difference |

Median Home Price | $440,000 | $416,100 | +5.7% |

YoY Price Change | +7.3% | +6.0% | +1.3% |

Days on Market | 34 days | 45 days | -24.4% |

Inventory YoY Change | +13.9% | +8.2% | +5.7% |

Price per Sq Ft | $259 | $223 | +16.1% |

Las Vegas continues outperforming the national market both in appreciation and how quickly homes sell, while also experiencing a faster inventory recovery. For more detailed monthly insights, check out my recent Las Vegas Real Estate Market Update (April 2024), and for migration data that's driving our market, see the Scientific research on migration trends.

Key Price Trends & YoY Changes

The Las Vegas real estate market analysis shows single-family homes have reached a median price of $475,000 as of December 2024 – a solid 5.6% increase from the previous year. While we're not seeing the wild double-digit jumps of the post-pandemic era, this steadier pace is actually healthier for long-term stability.

Interestingly, the condo and townhome segment has been the star performer lately. Median prices for attached homes hit $315,000 in May, representing a substantial 14.3% year-over-year increase. This stronger performance reflects growing demand for more affordable options.

The luxury segment (homes over $1 million) remains remarkably stable with 159 luxury homes sold in May 2025. Even with economic headwinds, affluent buyers continue to see Las Vegas as a desirable destination.

Housing Inventory Pulse

Active listings have been steadily climbing, with 9,908 homes for sale in May 2025 – that 13.9% increase from April is giving buyers more choices and reducing the extreme competition of recent years.

Our months-of-supply metric has increased to 2.7 months. While this is still below the 5-6 months that typically indicates a perfectly balanced market, we're making significant progress toward equilibrium.

Price reductions have become more common, with 28.3% of Las Vegas homes experiencing price drops in May 2024 – up 6.3 percentage points from last year. This signals sellers adjusting expectations to meet market reality.

Drivers of Demand & Supply in 2024-2025

Las Vegas has always danced to its own rhythm in the real estate world, and 2024-2025 is no exception. Let's look at what's really moving our market right now.

The economic landscape here continues to evolve beyond the bright lights of the Strip. While our unemployment rate sits at 6.7% (a bit higher than the national average), we're seeing promising job growth in tech, healthcare, and manufacturing. These new opportunities are helping fuel housing demand even as the job market finds its footing.

The California migration story remains one of our biggest headlines. Since 2020, more than 158,000 Californians have packed up and headed to Nevada, making up a whopping 43% of our new residents. That said, the flow has slowed somewhat recently – those 7% mortgage rates make it harder for potential transplants to sell their California homes and make the move east.

On the supply side, builders have ramped up construction, adding about 10,000 new homes in 2023. While that's progress, it still falls short of meeting our demand, especially for affordable housing. The good news? Builders are pulling more permits and launching new projects in 2025, which should help ease some of our inventory constraints.

Institutional investors remain players in our market, though their influence has decreased slightly. They currently account for about 23% of all home sales in the Las Vegas Valley – down from their peak but still a significant force shaping our market dynamics.

Population & Migration Dynamics

The Las Vegas population story continues to be one of growth, though the patterns are evolving. Los Angeles remains our number one source of new neighbors, with recent data showing 6,357 LA-based users searching for Las Vegas properties.

What's interesting is that we're now seeing more of a two-way street. Phoenix has emerged as the top destination for Las Vegas residents looking to move elsewhere. This creates a more dynamic population picture than the one-sided California exodus we saw during the pandemic peak.

Overall, our valley added 14,038 new residents last year – a 0.6% increase that outpaces many other metro areas. Clark County now tops 2.4 million people, with projections suggesting we could hit 3 million by 2042.

Remote work continues to reshape our neighborhoods. With more people able to live here while working elsewhere, communities like Summerlin and Henderson have especially benefited from an influx of remote workers seeking our lifestyle without sacrificing their careers.

Interest Rates & Affordability Pressure

Today's mortgage rates around 7% have created real challenges for many would-be buyers. The monthly payment on a median-priced Las Vegas home has jumped significantly compared to the historic lows of 2020-2021.

For a median-priced home of $475,000 with a 5% down payment, buyers now need a household income of about $134,000 to qualify for a mortgage. That's well above our forecasted median income of $78,538, meaning less than a third of Southern Nevada households can comfortably afford the median home price.

First-time buyers and those using FHA loans have felt this pinch most acutely. In response, we're seeing creative approaches to homebuying, including rate buy-downs, lender credits, down payment assistance programs, and increased interest in more budget-friendly neighborhoods.

New Construction & Infrastructure Boosts

The future of Las Vegas real estate is being shaped by some major infrastructure projects that promise to boost our appeal and economy:

The $3 billion Brightline West high-speed rail project, backed by $2.5 billion in bonds and scheduled for completion in 2027, will connect us directly to Southern California. This could be a game-changer for tourism and investment.

A proposed Las Vegas spaceport could integrate our region into the growing space economy, potentially creating high-paying jobs and new housing demand in surrounding areas.

Major entertainment investments are making waves too. Warner Bros. is planning an $8.5 billion expansion over 17 years, while Sony's $1.8 billion studio investment is expected to generate 16,000 jobs.

The built-to-rent segment is rapidly expanding, with developers creating entire neighborhoods of single-family homes specifically for rental. This trend is reshaping our rental market and creating interesting investment opportunities.

For a deeper dive into these trends, check out my analysis on Las Vegas Real Estate Trends and the latest news on our inventory surge.

Neighborhood Hotspots, Zip Codes & Rental Market

Las Vegas is like a patchwork quilt of distinct communities, each with its own personality and price point. If you're wondering where the action is happening right now, let me walk you through the hotspots that are capturing buyers' attention in 2025.

Summerlin, nestled against the western foothills, continues to be the crown jewel of Las Vegas communities with a median list price of $632,250 as of early 2025 – up 1.16% from just last month. It's not hard to see why people are willing to pay a premium here. With its tree-lined boulevards, championship golf courses, and schools that consistently rank among the best in Nevada, Summerlin offers the resort-style living many buyers dream about.

Henderson, to the southeast, continues its steady climb with a median list price now reaching $464,900 – a solid 2.18% increase month-over-month. What I love about Henderson is its versatility. You'll find everything from established neighborhoods with mature landscaping to brand-new communities with modern amenities.

For buyers looking for more affordable options, North Las Vegas deserves serious consideration. With a median list price of $399,900 (up 1.50% month-over-month), your dollar stretches further here. The area has seen a boom in new construction, creating fresh opportunities for first-time homebuyers who might be priced out of other parts of the valley.

Downtown Las Vegas is in the midst of an exciting renaissance. The Arts District is buzzing with energy as younger buyers and investors find the charm of urban living. While prices vary widely based on exactly which block you're looking at, the area's walkability and proximity to both the Strip and the authentic local culture make it increasingly attractive.

The rental market remains a bright spot in the Las Vegas real estate market analysis, with average rents growing approximately 4% year-over-year. Single-family homes now command an average rent of $2,100, with a price per square foot of $1.18. With vacancy rates hovering around just 4.8%, landlords continue to enjoy strong demand.

Fastest-Growing Zip Codes (2024)

When we look at which areas are seeing the most activity, a few zip codes stand out from the pack in our Las Vegas real estate market analysis.

Zip code 89166 in the northwest valley led all areas with an impressive 1,772 homes sold in 2024. This area offers a sweet spot of newer construction without the premium prices found in some other developing areas.

The Henderson zip code of 89052 continues to attract luxury buyers who appreciate its established neighborhoods and stunning views. Many homes here offer the perfect combination of mountain vistas and sparkling city lights – a quintessential Las Vegas experience.

The southwest valley's 89141 has been transformed by rapid development, with master-planned communities springing up seemingly overnight. This area has particularly strong appeal for families and professionals who value new construction with modern amenities.

For the luxury segment, 89135 (Summerlin) remains the gold standard, with average home prices exceeding $1.2 million. Meanwhile, the ultra-luxury market in 89052 (MacDonald Highlands) continues to set records, with some properties fetching over $10 million.

Rental Yields & Investor Opportunities

For those looking at Las Vegas through an investor's lens, the opportunities remain compelling despite changing market conditions. Cap rates for single-family rentals typically range from 5-7% depending on location and property condition – still attractive compared to many other major markets.

Short-term rental regulations have definitely tightened their grip in recent years. Both Clark County and the City of Las Vegas have implemented stricter permitting and operational requirements. While this has closed some doors, properly licensed and managed STRs in tourist-friendly areas can still generate returns that significantly outpace traditional long-term rentals.

The build-to-rent segment is perhaps the most interesting development in the investor landscape. Institutional investors are developing entire communities of rental homes, creating a new hybrid that offers the privacy of single-family living with the convenience of renting.

For more insights on finding affordable housing options in Las Vegas, check out my detailed guide on Affordable Housing Las Vegas, which explores neighborhoods and strategies for buyers on a budget.

Will There Be a Crash? Forecast 2025-2026

If I had a dollar for every time someone asked me about a potential housing crash, I'd probably own half of Summerlin by now! It's the million-dollar question on everyone's mind: will Las Vegas see another 2008-style housing collapse? Based on what I'm seeing in the data (and in the real world with my clients), a major crash appears highly unlikely for 2025-2026.

Instead of dramatic downturns, we're looking at something much more sustainable – price stability with modest growth of 3-5% annually. This is actually healthy news! Those double-digit price jumps from 2021-2022 weren't sustainable long-term, and this more moderate appreciation puts us back in line with historical norms while gradually improving affordability.

One key factor protecting us from a crash: our housing supply remains well below 2019 levels. Despite recent inventory increases giving buyers more options, we're nowhere near the glut of speculative inventory that crashed the market in 2008. Today's homeowners have substantial equity and stricter lending standards have prevented the risky loans that fueled the last crisis.

Mortgage rates will play a crucial role in determining market activity moving forward. If rates decline toward the 5-6% range as some economists predict, we could see a nice uptick in buying activity. But even if rates stay around 7%, the market is proving remarkably adaptable – people still need homes, regardless of interest rates.

When we compare Las Vegas to other major markets nationally, we're actually outperforming many regions in terms of price stability and demand. Our continued population growth and increasingly diverse economy provide buffers that we simply didn't have during previous downturns.

Scenario Analysis & Risk Factors

Let's look at a few potential scenarios that could impact our housing market:

If mortgage rates remain plateaued around 6-7% for an extended period (which seems increasingly likely), we'll probably continue seeing moderate price growth but reduced transaction volume. Both buyers and sellers are gradually adapting to this "new normal" rate environment.

A job-loss shock triggered by a broader economic recession could increase distressed sales and slow price appreciation. However, only 0.6% of Vegas sales in December 2024 were distressed properties – a far cry from the foreclosure tsunami of 2008-2010. Most homeowners today have substantial equity cushions to weather temporary financial storms.

What about an investor sell-off? While institutional buyers reducing their holdings could temporarily increase inventory in certain neighborhoods, our strong rental market makes this scenario less likely. Most investors are achieving solid returns with low vacancy rates, reducing incentives to exit the market.

Climate considerations are becoming increasingly important. About 27% of Las Vegas properties face "major" fire risk classifications, and water resources remain an ongoing concern. That said, innovations like the Strip's impressive 99% water recycling rate demonstrate our region's remarkable adaptability to these challenges.

Opportunity Matrix for Buyers & Sellers

Different market participants have unique opportunities in today's environment:

Buyers are gaining negotiating leverage as inventory grows and competition cools. I'm advising my buyer clients to target homes that have been listed over 30 days, as these sellers are often more motivated and receptive to reasonable offers. Don't be afraid to request seller concessions for closing costs or rate buy-downs – many sellers today understand they need to contribute to make deals happen.

Sellers need to adapt their pricing strategy to today's more balanced market. The days of ambitious "test" pricing are behind us – pricing realistically from the start yields better results than chasing the market down with multiple price reductions.

Investors should focus on value-add opportunities in the current market. Properties with deferred maintenance that can be renovated to increase value represent some of the best opportunities I'm seeing.

The Las Vegas housing market may be rebalancing, but it remains fundamentally sound. For personalized guidance on navigating these evolving conditions, check out my Las Vegas Housing Market Forecast or explore the latest scientific research on housing cycles for additional insights.

Frequently Asked Questions About Las Vegas Real Estate Market Analysis

How long are homes staying on the market in 2025?

The Las Vegas real estate market analysis shows homes are currently selling in about 34 days on average, a noticeable improvement from the 41-day average we saw this time last year. Even with more inventory available, well-priced homes aren't lingering on the market.

What's interesting is how dramatically this varies across different neighborhoods and price points. I've seen "hot homes" – those sweet-spot properties with the right price in desirable locations – get snatched up in just 12 days, often with multiple buyers competing. On the flip side, luxury properties or homes in less competitive areas might take 60+ days to find the right buyer.

The percentage of quick sales has shifted too. Last December, nearly 58% of homes sold within their first month on market. Now that figure has dropped to 50%. This gives today's buyers a bit more breathing room to make decisions, while sellers should mentally prepare for a slightly longer sales process.

Is Las Vegas currently a buyer's, seller's, or balanced market?

We're witnessing a fascinating transition in Las Vegas toward a more balanced market, though it's not uniform across all segments. With 2.7 months of inventory (as of December 2024), we're technically still in seller's market territory according to industry standards (anything under 5 months favors sellers).

However, the signs of balancing are unmistakable. Inventory has nearly doubled year-over-year (up 97.6% in May 2025), and more than half of homes (54%) are now selling below asking price. The pendulum is clearly swinging toward the middle.

The market feels different depending on where you're looking. Under $400,000, competition remains fierce with first-time buyers still facing limited options. In the mid-range ($400,000-$800,000), balance is emerging more clearly with buyers gaining genuine negotiating power.

How are high mortgage rates impacting demand?

With mortgage rates hovering around 7% in early 2025, the impact on buying power has been substantial. First-time buyers have felt this most acutely – many have had to postpone their purchase plans or adjust expectations about location, size, or amenities.

Rate buy-downs have become a popular solution, with sellers and builders offering to temporarily reduce interest rates for the first year or two of ownership. This clever strategy helps buyers manage initial payment shock while hoping for an opportunity to refinance when rates eventually fall.

The lock-in effect continues to influence our market dynamics. Homeowners who secured rates in the 2-4% range remain reluctant to sell and take on new financing at today's higher rates. This has contributed to our inventory constraints, especially in middle price ranges.

Cash buyers now enjoy increased leverage since they can sidestep rate concerns entirely. Interestingly though, cash transactions have actually decreased to 26.2% of December 2024 sales, down significantly from 59.5% in December 2013.

Conclusion & Next Steps

The Las Vegas real estate market in 2025 presents a fascinating mix of challenges and opportunities. As we transition to a more balanced market, everyone from first-time buyers to seasoned investors is finding new ways to steer this evolving landscape.

Throughout our Las Vegas real estate market analysis, we've seen several key trends emerging that will shape the coming months:

The steady growth in inventory is giving buyers more breathing room and choices after years of frantic competition. At the same time, prices continue to appreciate at a healthier, more sustainable pace that benefits long-term market stability.

The exciting infrastructure developments and economic projects underway will inevitably reshape neighborhood values across the valley. And of course, we're all watching mortgage rates closely, as even small movements can significantly impact affordability and buyer demand.

I've been helping clients through Las Vegas market cycles for years, and if there's one thing I've learned, it's that real estate isn't one-size-fits-all. Your family's needs, financial situation, and long-term goals create a unique picture that deserves personalized attention.

When clients work with me, they get more than just market statistics. I combine comprehensive data analysis with boots-on-the-ground knowledge of neighborhood dynamics that you simply can't get from online listings. I'm constantly monitoring market indicators and neighborhood trends to help you time your decisions perfectly and spot hidden gems before they become obvious to everyone else.

Maybe you're a first-time buyer trying to make sense of affordability challenges, a homeowner wondering if now's the right time to sell, or an investor looking to optimize your portfolio in this changing market. Whatever your situation, I'm committed to helping you develop a smart, data-driven strategy that aligns with your personal goals.

The Las Vegas market continues to offer tremendous opportunities for those who approach it with the right information and guidance. I'd love to help you cut through the noise and find your perfect path forward in this dynamic market.

For more information about available properties or to discuss your specific real estate goals, please reach out anytime. I'm here to help you turn market knowledge into real-world success.

.png)

Comments